Contents

Inspectors were sure that he was doing something illegal, but despite the fact that he sent messages to his investors through the mail, they could not arrest him for fraud, because at that point no one was complaining of being cheated. These early funders were still flush with money pouring in from new investors. Ponzi scheme organizers often promise to invest your money and generate high returns with little or no risk. Instead, they use it to pay those who invested earlier and may keep some for themselves.

They also said the company would go public on the Hong Kong Stock Exchange. Thailand is no stranger to Ponzi schemes, especially in real estate and currency/stock investments. https://cryptolisting.org/ It got so bad in the 1980s that the government stepped in with a strange-sounding law called “The Emergency Decree on Borrowings which Constitutes Fraud to the Public B.E.

Origins of the Ponzi Scheme

With little or no legitimate earnings, Ponzi schemes require a constant flow of new money to survive. When it becomes hard to recruit new investors, or when large numbers of existing investors cash out, these schemes collapse. As a result, most investors end up losing all or much of the money they invested. In some cases, the operator of the scheme may simply disappear with the money. The swindler convinces the victim that he or she has just found a large sum of money (in a bag on the street, left behind on a park bench, etc.) with no way to identify the owner.

On Murdoch Mysteries Home for the Holidays special Inspector Brankenreid is conned by Ponzi and The Inspector and Constable Crabtree work to get the money back. While working at a mining camp as a nurse, he came up with the idea of going to another mining camp, starting a utility there that would supply water and power, and selling its stock. During this time, a fellow nurse called Pearl Gosid had suffered severe burns in an accident. Despite not knowing her, Ponzi volunteered for two major operations to donate 122 square inches of his skin from his back and legs to Pearl. This resulted in pleurisy and similar complications, and Ponzi losing his job.

- Avoid investments if you don’t understand them or can’t get complete information about them.

- Attorney General Allen declared that if Ponzi managed to regain his freedom, the state would seek additional charges and seek a bail high enough to ensure Ponzi would stay in custody.

- Even though many consumers may think Ponzi schemes are rare and easy to spot, in reality, Ponzi schemes are common, and can fool even very experienced investors into investing large sums of money.

Investigators suspect Madoff’s Ponzi scheme was started in the early 1980’s and lasted over 30 years. This type of exchange is known as an arbitrage, which is not an illegal practice. With the release came an immediate order to have him deported to Italy. He asked for a full pardon from Massachusetts Governor Joseph B. Ely. Ponzi’s charismatic confidence had faded, and when he left the prison gates, he was met by an angry crowd. He told reporters before he left, “I went looking for trouble, and I found it.” On October 7, Ponzi was officially deported.

They use vague verbal guises such as “hedge futures trading”, “high-yield investment programs”, or “offshore investment” to describe their income strategy. It is common for the operator to take advantage of a lack of investor knowledge or competence, or sometimes claim to use a proprietary, secret investment strategy to avoid giving information about the scheme. Any “guaranteed” investment opportunity should be considered suspect.

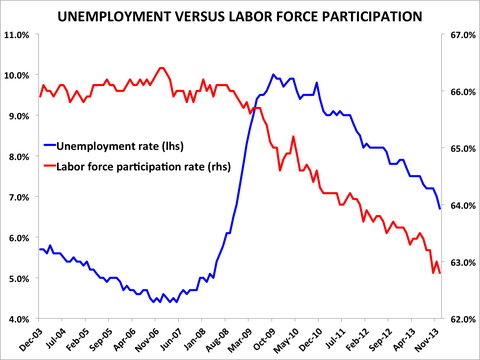

Some perfectly legal investments have characteristics in common with Ponzi schemes. Anyone facing Ponzi scheme criminal charges could face jail time, disgorgement (an order to repay ripped-off investors), and fines. Shavers promised investors astonishingly high returns of 7% per week on their Bitcoin investments. INTERPOL’s global network is further supporting on-going police investigations in Poland where criminals tied to the Ponzi scheme have allegedly scammed thousands of victims. In 2008, as the global economy began to decline, large numbers of Madoff investors needed money and began asking to cash in their investments. That’s when Madoff’s Ponzi scheme burst – he did not have enough money to cover his investors’ requests and new investor money was hard to be found in the economic downturn.

Ponzi set up a larger office, this time in the Niles Building on School Street. Between February and March 1920, the total amount invested had risen from $5,000 to $25,000 ($70,000 to $340,000 in 2021, respectively). As the scheme grew, Ponzi hired agents to seek out new investors in New England and New Jersey. At that time, investors were being paid impressive rates, which subsequently encouraged others to invest. By May 1920, he had made $420,000 (equivalent to $5,700,000 in 2021). By June 1920, people had invested $2.5 million in Ponzi’s scheme (equivalent to $34,000,000 in 2021).

In the first month, 18 people invested in his company with a total of $1,800. He paid them promptly, the very next month, with the money obtained from the newer set of investors. Ponzi set up a small office at 27 School Street, Boston, in the summer of 1919 attempting to sell business ideas to contacts in Europe. Ponzi stayed in Montreal and, for some time, lived at Zarossi’s house helping the man’s abandoned family while planning to return to the U.S. and start over. Confronted by police who had taken note of his large expenditures just after the forged check was cashed, Ponzi held out his wrist up and said, “I’m guilty”. He ended up spending three years at St. Vincent-de-Paul Federal Penitentiary, a bleak facility located on the outskirts of Montreal [Inmate #6660].

He called a meeting with federal, state, and local authorities on Monday, July 26, 1920 during which he suggested they audit his books. Also at his own suggestion, Ponzi agreed to stop taking investments during the audit in order to make the job easier. In this attempt to reassure the public, Ponzi caused his own demise. The next day angry investors crowded his office to demand their money—they feared that Ponzi was about to close up shop.

For General Consumer Complaints, Contact the Attorney General’s Consumer Protection Division

Ponzi was arrested in 1920 and charged with multiple counts of fraud and larceny and sentenced to prison. A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. In the 1920s, Ponzi promised investors a 50% return within a few months for what he claimed was an investment in international mail coupons.

It also ruled that Ponzi was not facing double jeopardy because Massachusetts was charging him with larceny while the federal government charged him with mail fraud, even though the charges implicated the same criminal operation. When a Boston financial writer suggested there was no way Ponzi could legally deliver such high returns in a short period of time, Ponzi sued for libel and won $500,000 in damages. As libel law at the what is hawala.exchange time placed the burden of proof on the writer and publisher, this effectively neutralized any serious probes into his dealings for some time. People were mortgaging their homes and investing their life savings. Ponzi’s company, meanwhile, had set up branches from Maine to New Jersey. ], following the collapse of a Ponzi scheme, even the “innocent” beneficiaries are liable to repay any gains for distribution to the victims.

Many of Madoff’s victims invested because people they knew and trusted, such as friends and even family members, encouraged them to do so. If someone gives you an “inside” tip, don’t just hand over your money. The most famous modern Ponzi scheme was orchestrated by Bernie Madoff.

Between the years 2008 through 2013, the average size Ponzi scheme involved approximately $98 million. Of the schemes uncovered since 2008, over 400 prison sentences, totaling nearly 5,000 years, have been delivered to the perpetrators of these schemes. If you think you may be a victim of a Ponzi scheme you should contact law enforcement, legal counsel and a forensic accountant.

Examples of Pyramid Schemes:

People more often trust members of their own community, adding to the scammer’s credibility. Check with your state/provincial securities regulator to determine if the individuals and firms selling the investment are properly registered with your state/province. If the promoter says he’s exempt, follow-up with your regulator to confirm the claim. Diversify not only your assets but also your money managers, accounts, and financial institutions. Spreading your money around will limit your exposure to the financial problems of any one institution. Victims in the Madoff case who were financially stable after the scam were the ones who invested only a percentage of their assets with Madoff, not their entire life savings.

On the same day, Ponzi received a preview of Pride’s audit, which revealed Ponzi was at least $7 million in debt. On July 26, the Post started a series of articles that asked hard questions about the operation of Ponzi’s money machine. The paper contacted Clarence Barron, the financial journalist who headed Dow Jones & Company, to examine Ponzi’s scheme. Barron observed that though Ponzi was offering fantastic returns on investments, Ponzi himself was not investing with his own company. It was at Banco Zarossi that Ponzi first saw the scheme of “robbing Peter to pay Paul” . Zarossi paid 6% interest on bank deposits—double the going rate at the time—and was growing rapidly as a result.

Public education to expose the games is perhaps the most effective preventive tool. Laundering money is another crime which is difficult to detect and prosecute. Laundering involves finding some feasible legal source to use as a cover for illegally gained money, so that income taxes can be paid and the money becomes respectable.

Madoff – A 21st Century Ponzi Scheme

Watch out for promoters who do not provide you with clear explanations of how the investment works, or who refuse to provide you with detailed information in writing. If the person selling the investment refuses to explain how the investment works because it is “too complicated” or “not something you need to worry about”, this is a warning sign of potential trouble. The same is true if a seller refuses to provide you with written information on the investment, and how it works. It is very important that you understand your investments and how they work.

Go to Crime Victim Rights In Michigan, a victim is an individual who suffers direct or threatened physical, financial, or emotional harm as a result of the commission of a crime. Go to Charitable Trust The Charitable Trust Section functions for Michigan citizens as a repository of financial and other information about charities they may want to support. At any one time there are more than 8,000 charities registered with the Attorney General’s Charitable Trust Section. Most charities soliciting contributions in Michigan are required to register with the Charitable Trust Section. One of the goals of the Attorney General is to help educate the public and to assist them in making wise choices about what charities to support. Avoid investments if you don’t understand them or can’t get complete information about them.

Ponzi scheme suspects wanted via INTERPOL arrested in Greece and Italy

Charles Ponzi successfully sued the writer for libel and won $500,000—a major discouragement for any future whistleblowers. A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors. A Ponzi scheme is a fraudulent investing scam which generates returns for earlier investors with money taken from later investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers. Theoretically, it is possible for certain Ponzi schemes to ultimately “succeed” financially, at least so long as a Ponzi scheme was not what the promoters were initially intending to operate. For example, a failing hedge fund reporting fraudulent returns could conceivably “make good” its reported numbers, for example by making a successful high-risk investment.

This doesn’t seem to bother him, in part because he is a born optimist and thinks this online scam-busting thing could one day catch on. Viewers have sent him dozens of links to likely online Ponzi schemes, and he plans to name and shame them all. Last November, Bitcoin began an epic decline, from about $64,000 apiece to roughly $16,000 today.

Leave a Reply